- To further improve the resilience of these strategies, we are continually considering ways to identify, assess, and respond to climate-related risks and opportunities.

- Our approach to these considerations is to start by identifying climate-related risks and opportunities, and then qualitatively evaluate their impact and other aspects before proceeding to more detailed analysis, taking into account the relative importance, availability of analytical data, and other factors.

- In this series of processes, we consider how things will unfold by comparing two scenarios: a world where climate change is limited (a world where the global mean temperature increase since the Industrial Revolution is limited to around 1.5°C to 2°C (the 1.5°C/2°C scenario)) and a world where climate change continues to progress (a world where the global mean temperature increase since the Industrial Revolution is around 4°C or higher (the 4°C scenario)). In general, under the 1.5°C/2°C scenario, carbon taxes and other laws and regulations are strengthened and consumer preferences change notably, while under the 4°C scenario, climate change becomes more severe, and windstorms, floods, and other natural disasters increase in intensity and frequency.

(2-1) Identifying and assessing climate-related risks and opportunities

- First, we identified short-, medium-, and long-term climate-related risks and opportunities for the Group and qualitatively assessed the financial implications thereof (Table 1).

- Potential risks with significant impact on our business operations include increased costs due to carbon taxes, expenses from purchasing CO2 allowances, increased capital investment costs associated with decarbonization, increased raw material procurement costs due to more prevalent sustainability-conscious buying behavior and more frequent and severe natural disasters, decreased sales due to declining consumer spending caused by dwindling product value, and decreased product supply capacity and sales when production plants are damaged.

- Potential opportunities with significant impact on our business operations include reducing production costs through improved efficiency in energy, water, and other resources, and increasing sales by developing and selling products that accommodate changes in consumer and customer buying behavior.

▼ Table 1: List of climate-related risks and opportunities

Definition of terms

- Timing: Indicates the shortest timeframe in which the risk/opportunity could occur. The timing is a qualitative judgment based on short-term meaning less than five years, medium-term meaning five to no more than 10 years, and long-term meaning 10 or more years. Notably, risks and opportunities that have already emerged are marked as short-term. This definition of timing is consistent with the timeframe of the Group’s management strategies (Value Up+ for short-term strategy through 2024, and The Nisshin OilliO Group Vision 2030 for medium-term strategy through 2030).

- Likelihood: Indicates the likelihood or probability that the risk/opportunity will actually occur, rated qualitatively on one of three levels (high/medium/low). Notably, risks and opportunities that have already emerged are marked as high.

- Impact: The extent to which the risk/opportunity, once realized, would affect the Company, primarily in terms of financial impact, rated qualitatively on one of three levels (large/medium/small).

- ★: Indicates a trial quantification of impact (in monetary terms).

| Classifications | Financial impact | Impact | Likelihood |

Timing | ||||

|---|---|---|---|---|---|---|---|---|

| Short-term | Medium-term | Long-term | ||||||

| Risks | Transition | Policy and legal | Higher carbon taxes could increase the cost of energy, containers, transportation, and the like. Additionally, introducing a corporate CO2 emissions trading scheme could trigger expenses from purchasing allowances. (★) | Large | High | |||

| Stricter traceability-related laws and regulations could result in greater demand for certified raw materials, causing raw material prices to increase, trigger capital investment expenses, increase administrative costs, and result in fines or negatively impact sales due to violations. | Medium | High | ||||||

| Changes in the social environment caused by climate change and the impact of stricter laws and regulations could give rise to legal action in response to violations, deforestation, and human rights issues in the supply chain. | Medium | Low | ||||||

| A shift away from conventional, environmentally taxing farming methods and an increase in land use regulation strictness could result in lower production volumes and higher labor costs, leading to higher raw material prices. (★) | Large | High | ||||||

| Technology | The development and diffusion of decarbonization technologies could require businesses to introduce large-scale facilities to decarbonize production systems, increasing capital investment expenses. Additionally, investments might not be as effective as expected, and new breakthrough technologies might not be introduced due to lack of funds. | Large | High | |||||

| Market | The price of environmentally friendly raw materials—namely soy, rapeseed, and palm—could increase due to more prevalent sustainability-conscious buying behavior. Additionally, if sustainability cannot be guaranteed, sales could decrease due to declining consumer spending caused by dwindling product value. | Large | High | |||||

| Reputation | As ESG investments accelerate, the Group’s stock price or financing could stagnate if the Group’s ESG efforts are delayed or its disclosures are inadequate. Additionally, the unintended spread of rumors could reduce corporate value. | Medium | Low | |||||

| Physical | Acute | Areas where raw materials are produced could suffer due to increasingly frequent and severe natural disasters, reducing yields and causing raw material prices to soar. Additionally, if production plants are damaged, sales could decrease due to the temporary reduction in the production, sales, and logistics capacity. (★) Also, the unintended spread of rumors could reduce corporate value. | Large | High | ||||

| Chronic | Changes in weather patterns (e.g., rising temperatures, changes in precipitation) could negatively impact the growth of soy and palm, reducing production volumes and increasing raw material prices. These changes could also negatively impact the quality and safety of raw materials and the stability of the supply of products. Additionally, the unintended spread of rumors could reduce corporate value. | Large | Medium | |||||

| Opportunities | Resource efficiency | Improved resource efficiency (e.g., introducing more efficient equipment in terms of energy and water consumption, advanced production management) could reduce production costs. | Large | High | ||||

| Promoting resource recycling by promoting plastic recycling and switching to containers made of bioplastics and plastic alternatives could help stabilize procurement for containers and packaging materials and add value to products, thereby improving customer assessment. | Medium | High | ||||||

| Energy source | Selling products with lower CO2 emissions (Scope 1 and 2) and promoting added value through the use of renewable energy could lead to greater satisfaction and increased sales to customers looking to reduce supply chain emissions. | Medium | High | |||||

| Markets of Products/services | Sales could increase through the development and sale of products (e.g., plant-based cosmetics, functional foods, certified palm oil) that accommodate changes in consumer and customer buying behavior (e.g., ethical consumption, health- and nature-oriented behavior). | Large | High | |||||

| Resilience |

Widespread adoption of drought- and heat-tolerant agricultural products could stem reductions in raw material production volumes and supply instability due to climate-related damage (e.g., heat waves, droughts). | Medium | Medium | |||||

| Strengthening the BCP—even if natural disasters become more frequent and severe due to climate change—could allow the Company to maintain its system for supplying products during emergencies, helping stabilize and increase sales, improving its social value, increasing its stock price, and facilitating fundraising. | Medium | High | ||||||

- Of the risks identified above, we have analyzed three in detail this year: (1) Changes in raw material yields and prices, (2) Cost increases due to carbon taxes, ETS, and the like, and (3) Decrease in profits due to shutdowns caused by meteorological disasters. For specific considerations, we referred to qualitative and quantitative information (e.g., grain price forecasts) under the scenarios published by the IPCC, IEA, FAO, NGFS, and other international organizations.

- Abbreviations

- IPCC: Intergovernmental Panel on Climate Change, an intergovernmental organization that aims to provide a scientific basis for national governments’ climate change policies.

- IEA: International Energy Agency, an international organization established in the wake of the 1973 oil crisis to cover energy security and all other aspects of energy policy.

- FAO: Food and Agriculture Organization of the United Nations, a UN agency that promotes food security and nutrition, agriculture (including crops, livestock, fisheries, and aquaculture), and rural development.

- NGFS: Network for Greening the Financial System, an international network of central banks and financial supervisory agencies for considering financial supervisory responses to climate change risks.

(ⅰ) Changes in raw material yields and prices

First and foremost, the following table shows the projected changes in yields for each major raw material. Essentially, yields appear to trend upward for each raw material.

| Soy | Rapeseed | Palm | Cacao | |

|---|---|---|---|---|

| Total global yield under the business-as-usual (BAU) scenario through 2050, indexed to the most recent results (2012 = 100) |

143 | 150 | 158 | 126 |

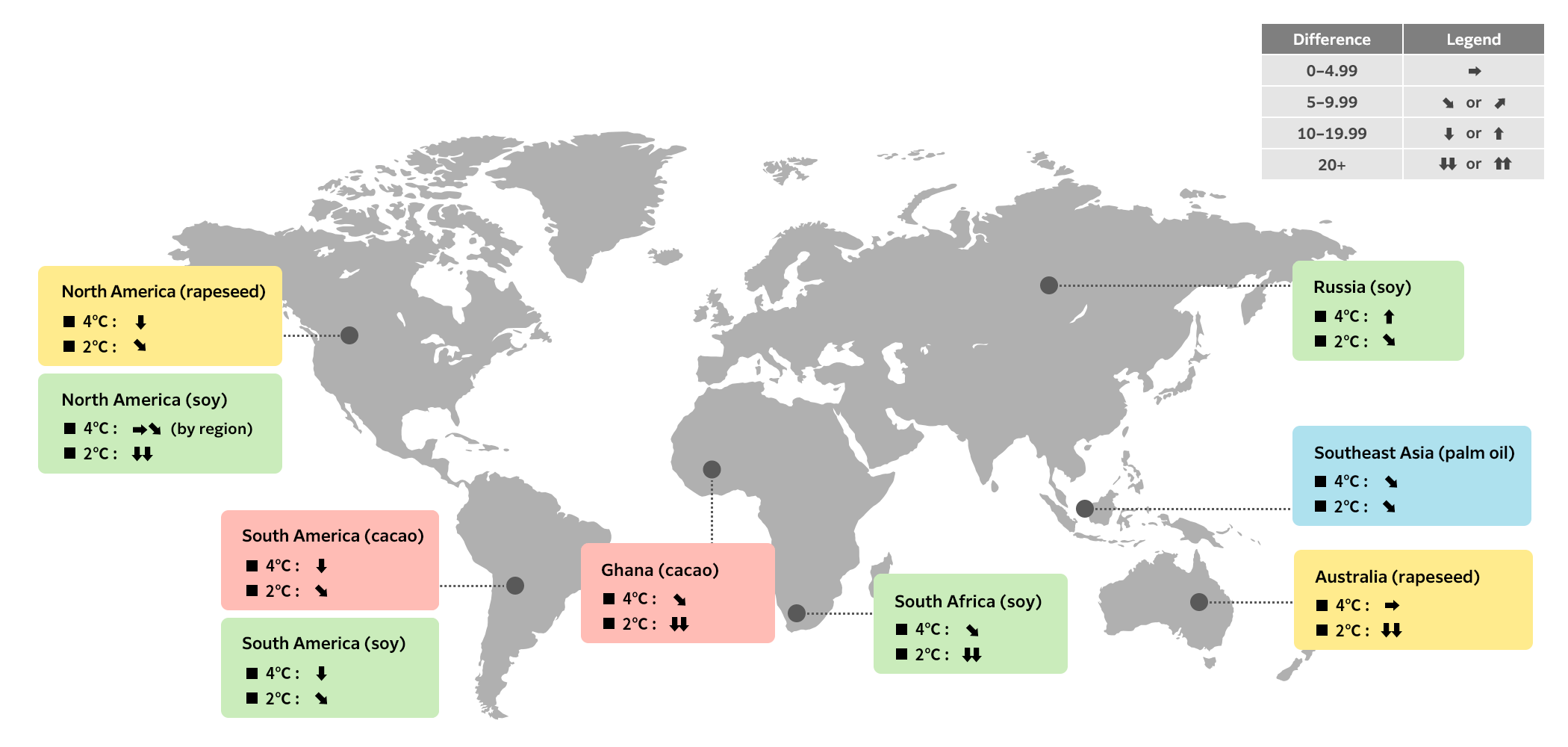

Next, to understand the differences in impact under the 2°C and 4°C scenarios, we created Figure 2 using changes in yield per unit through 2050 under the 2°C and 4°C scenarios, indexed to the BAU scenario through 2050 (set to 100) from FAO. The legend in the upper right part of the figure shows the classifications.

▼ Figure 2: Risk of changes in raw material yields

- * Analysis based on FAO yield scenario values.

- * Locations on the map in North America, South America, and Southeast Asia do not refer to specific countries.

The analysis shows that yields will essentially increase worldwide through 2050; however, comparing the 2°C and 4°C scenarios to the BAU scenario, the analysis shows that soy and rapeseed yields will hold steady or increase in some areas under the 4°C scenario, but the yields for all raw materials will decrease in all areas under the 2°C scenario. This is presumably due to policy factors (e.g., land use regulations and restrictions on environmentally taxing farming methods) having a greater impact than worsening climate conditions in some regions and countries, despite the combined impact of the various factors included in the scenarios. Notably, in the future, we will consider demand trends as well as supply trends, and delve deeper into our analysis from both perspectives.

Regarding changes in the price of raw materials, the annual increase in procurement costs due to changes in soy prices between 2030 and 2050 was calculated for the United States and Brazil—major producers of soy, one of the main raw materials—using the NGFS 1.5°C scenario. Changes in prices under this scenario reflect the cost of carbon pricing and production efficiency improvements, and the calculations show the financial impact of transition risk.

▼ Table 2: Financial calculations of raw soy price increases due to decarbonization in agriculture

| Scenario | Country | 2030 procurement cost increase (billion yen/year) |

2050 procurement cost increase (billion yen/year) |

|---|---|---|---|

| 1.5°C | USA | 13.1 | 21.0 |

| Brazil | 3.4 | 4.9 |

Financial impact of changes in prices based on mean annual purchase amount in 2020–2022

As for prices, the price of soy from both the United States and Brazil will increase under the 1.5°C scenario, representing the largest impact among risk items for which financial impacts were calculated (totaling ¥16.5 billion/year in 2030 and ¥25.9 billion/year in 2050). We plan to examine the impact of changes in the prices of rapeseed, palm oil, and other raw materials in the future.

(ⅱ) Cost increases due to carbon taxes, ETS, and the like

We used carbon pricing from the Announced Pledges Scenario (2.0°C) and the Net Zero Emissions by 2050 Scenario (1.5°C) in the IEA’s World Energy Outlook 2022 to calculate the annual financial burden posed by carbon pricing in 2030 and 2050 for both The Nisshin OilliO Group, Ltd. (Japan) and ISF (Malaysia), the largest greenhouse gas emitters in the Group. These two companies account for more than 96% of the Scope 1 and 2 emissions managed by the Group.

▼ Table 3: Financial calculations of cost increases due to carbon taxes, ETS, and the like

| Scenario | In-house measures | Company name | 2030 financial burden (billion yen/year) |

2050 financial burden (billion yen/year) |

|---|---|---|---|---|

| 2.0°C | Status quo | The Nisshin OilliO Group, Ltd. | 2.7 | 4.0 |

| ISF | 0.84 | 3.3 | ||

| Achieving reduction targets | The Nisshin OilliO Group, Ltd. | 1.6 | 0 | |

| ISF | 0.4 | 0 | ||

| 1.5°C | Status quo | The Nisshin OilliO Group, Ltd. | 2.8 | 5.0 |

| ISF | 1.9 | 4.2 | ||

| Achieving reduction targets | The Nisshin OilliO Group, Ltd. | 1.7 | 0 | |

| ISF | 0.91 | 0 |

Status quo: Calculated based on FY2022 CO2 emissions

Achieving reduction targets: Calculated with a 50% reduction in emissions in 2030 (compared with 2016), zero emissions in 2050

Carbon pricing: See WEO 2022, IEA

| 2030 | 2050 | |||

|---|---|---|---|---|

| 2.0°C | 1.5°C | 2.0°C | 1.5°C | |

| The Nisshin OilliO Group, Ltd. | $135 | $140 | $200 | $250 |

| ISF | $40 | $90 | $160 | $200 |

The above analysis of the risk of cost increases due to carbon taxes, ETS, and the like suggests that the financial burden in 2030 can be roughly halved by achieving the reduction targets under both the 2.0°C and 1.5°C scenarios. If the reduction targets are achieved, the total financial burden for the two companies in fiscal 2030 would be ¥2.0 billion/year under the 2.0°C scenario and ¥2.61 billion/year under the 1.5°C scenario.

(ⅲ) Decrease in profits due to shutdowns caused by meteorological disasters

For this analysis, we envisioned shutdowns of our domestic operations due to flooding. Additionally, since physical risks are long-term, the analysis only covers 2050. We calculated the annual decrease in operating profit due to shutdowns under the IPCC’s 4°C and 2°C scenarios.

▼ Table 4: Financial calculations of decrease in profits due to shutdowns caused by meteorological disasters

| Scenario | Country | Annual decrease in operating profit due to shutdowns in 2050 (million yen/year) |

|---|---|---|

| 4.0°C | Japan | 176 |

| 2.0°C | Japan | 132 |

- Annual decrease in operating profit = Frequency of disasters x Number of shutdown days x Annual operating profit ÷ 245 days

- The frequency of disasters is based on the number of occurrences of daily precipitation of 200 mm or more on the east side of East Japan (0.4 times/year under 4.0°C scenario; 0.3 times/year under 2.0°C scenario) according to “Climate Change in Japan 2020, Detailed Version” by the Ministry of Education, Culture, Sports, Science and Technology and the Japan Meteorological Agency.

- The number of shutdown days is based on the corresponding figure (10 days) for below floor-level inundation according to the “Manual for Economic Evaluation of Flood Control Investment” by the Ministry of Land, Infrastructure, Transport and Tourism.

The above analysis of the risk of a decrease in profits due to shutdowns caused by meteorological disasters suggests that even under the 4.0°C scenario—considered to have a large impact from meteorological disasters—the impact is only 176 million yen/year, the smallest among the risk items for which financial impacts were calculated. For future analysis, we plan to consider expanding the number of countries and the impact of property damage (e.g., repair costs) resulting from disasters.