- Nisshin OilliO HOME

- About Us

- Who We Are

1Introduction

We are committed to become a global provider of oils and fats solutions.

Business Segments

Oil and Fat

Oils and meals

Household-use oils

Commercial-use oils

Oils used for food processing

Processed oils and fats

Oils and fats for chocolate

Processed palm oil

Margarines

Shortenings

Processd Food and Materials

Chocolates

MCT products

Fine Chemical

Raw materials for cosmetics

Lubricant for food-processing machinery

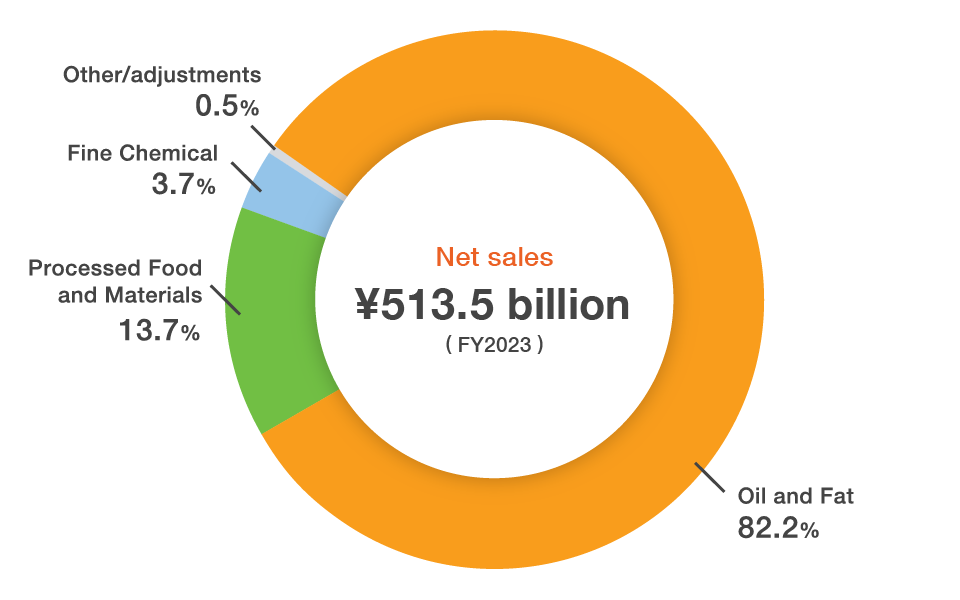

Business segments (Net sales & operating profit ratios)

| Segments | Businesses | Net sales |

Operating profit |

|

|---|---|---|---|---|

| Oil and Fat | Oil and meal | Edible oils for household-use, commercial-use, for food processing; oil meals | 317.9 | 14.4 |

| Processed oils and fats | Oils & fats for chocolate, margarines, shortenings | 103.9 | 4.5 | |

| Processed Food and Materials | Chocolates, seasonings (salad dressings) MCT products | 70.1 | 0.9 | |

| Fine Chemical | Raw materials for cosmetics, environment and hygiene-related products | 18.8 | 1.2 | |

| Other/adjustments | 2.5 | (0.3) | ||

Strengths that generate oils and fats solutions

Expansion of earning potential, leading to further growth

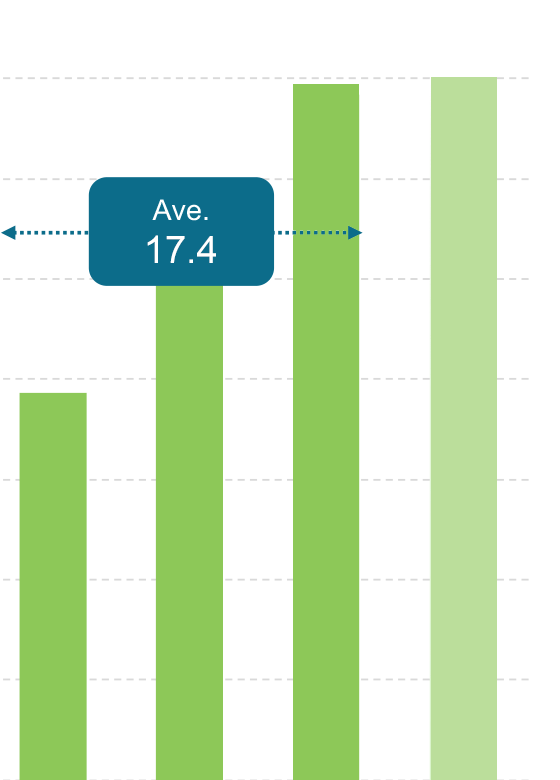

Consolidated operating profit

|

|

|

|

|

|

||||||||||

|

GROWTH 10 | 3-year Plan | OilliO Value Up 2020 | Value Up+ | |||||||||||

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 (target) |

||

| ROE | 3.5% | 1.4% | 2.0% | 3.0% | 4.2% | 6.3% | 5.4% | 6.6% | 5.9% | 6.5% | 5.7% | 7.0% | 8.8% | 8.0% | |

Review of shareholder return policy

|

- The shareholder return policy was revised to provide a consolidated dividend payout ratio of 40% looking ahead to FY2024, the final year of the Value Up+ Medium-term Management Plan, with the assumption of continued stable dividend payments.

- Profit growth and improved return on capital achieved through active investment intended to increase corporate value shall be reflected in shareholder returns.

2Strategy

Vision 2030

Our objective is to co-create new food functions, leveraging “The Natural Power of Plants” and the strengths obtained from mastering oils and fats.

We shall strive to generate diverse values and deliver “energy for living” to everyone.

- ROE 10%

- ROIC 7%

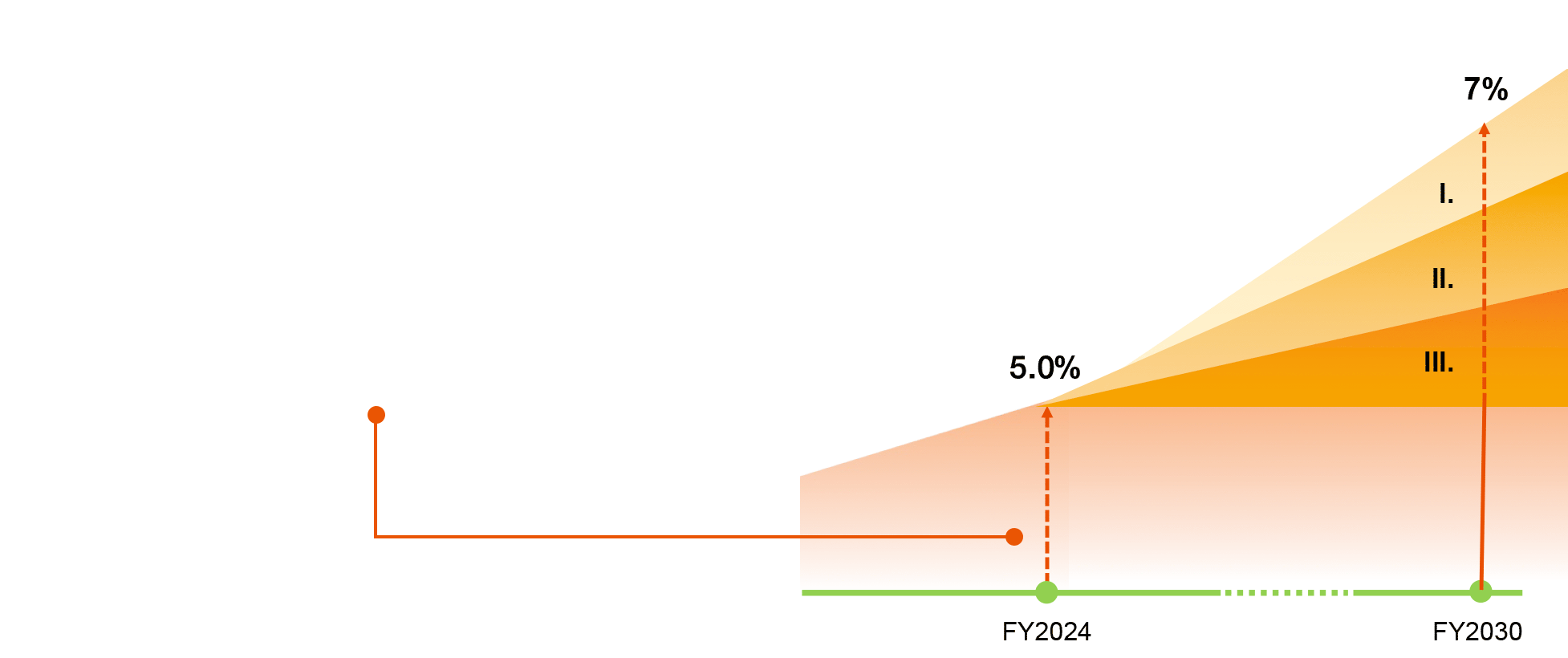

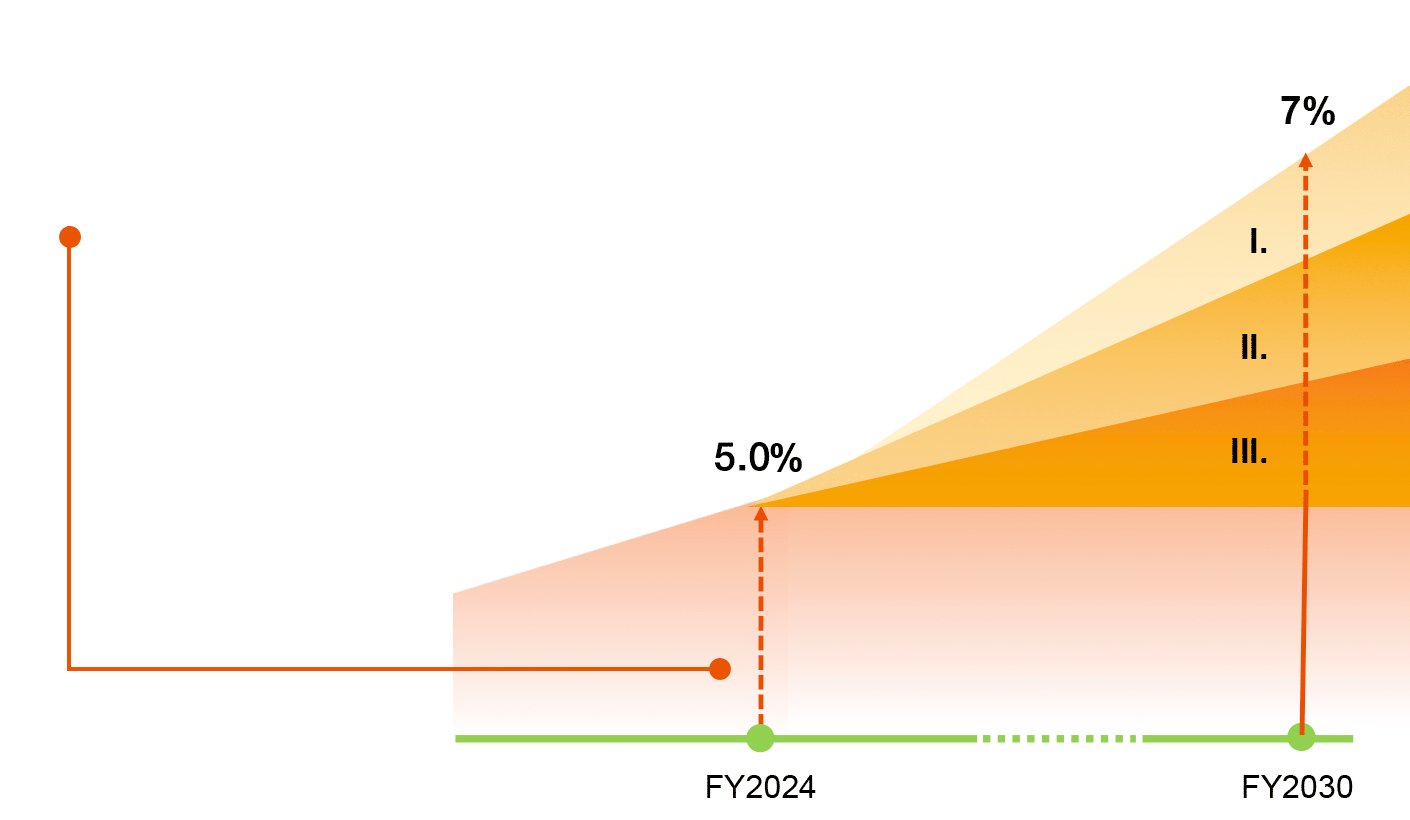

Key points for setting ROE and ROIC as business targets

- Net sales have increased rapidly in the last two years due to historically high oil prices. Future sales and operating profit margin levels are also unpredictable.

- The target for ROE was set at 10%. The ROIC target in improving profitability in each business area was set at 7%.

- The level of profit increase is expected to be ¥30 billion in operating profit. To achieve this, we will promote initiatives to create value and improve profitability.

Policy on and target for improving capital profitability

- Policy

- Improve PBR levels by achieving an ROE level that exceeds equity costs and sustainable growth

- ROE Target in FY2030: 10%

- To achieve the company-wide ROE target, we are working to improve the profitability of individual business units by making ROIC a management indicator

|

Measures to achieve 10% ROE (by 2030)

ROIC target value was set at 7% to achieve 10% ROE, by implementing measures in each business segment

To achieve 7% ROIC

- Create value in domestic oil and fat market and reinforce solutions

- Set and maintain appropriate prices suitable for costs

- Expand sales of specialty fats

- Take action to capture recovered demand in the fine chemical and chocolate businesses, among others.

I. Develop new markets in North America

- KPI

-

Expand sales: +¥50 billion, 10% ROIC

- Build tbusiness models that leverage our technological strengths to conduct business in multiple areas

- Make investments on a scale necessary for business development

II. Leap forward to become a global top provider of oils and fats solutions in the oil and fat processing field

- KPI

-

Operating profit growth rate*: 6%, 8% ROIC

- Establish a world-leading position in specialty fats

- Reinforce access to growth markets in the fine chemical business

- Increase profitability in the chocolate business in Japan and Asia

III. Achieve steady growth and raise profitability in the domestic oil and fat business Expand the scale of profit with an operating profit rate target of 6%

- KPI

-

Operating profit growth rate*: 5%, 5% ROIC

- Leverage our unique technologies to form a new price equilibrium point

- Create and expand markets through new value proposals

* Operating profit growth rate: Average compound annual growth rates (CAGR) from FY2019 to FY2030

Please see our IR Library/Management Policy page for more information.

IR Library / Management Policy